Attention Arbitrage

Memecoins are a scam

Memecoins are a scam

Thats what everyone says but memecoins are the most honest part of crypto, and their persistence across every single market narrative proves something uncomfortable: maybe they’re the signal, and everything else is noise.

Crypto promised to democratize finance. It succeeded , just not in the way anyone expected.

The ‘democratization’ isn’t that everyone can access DeFi primitives or participate in governance; it’s that anyone with a couple SOL (depending on the chain) and a sense of irony can launch a token ,ride whatever narrative is trending , and potentially make more than the PhDs building the actual infrastructure.

The trenches, that chaotic underbelly of memecoins, rugs and 100x gambles survives every bear market, every regulatory crack down, every wave of “ this is the top” think pieces. Why? Because they’ve solved for what crypto actually is: a global casino where the house is always open and the narrative is the product.

And the product has a formula.

The formula reveals itself when you look at specific case studies. Three narratives, three waves of memecoins, the same playbook everytime.

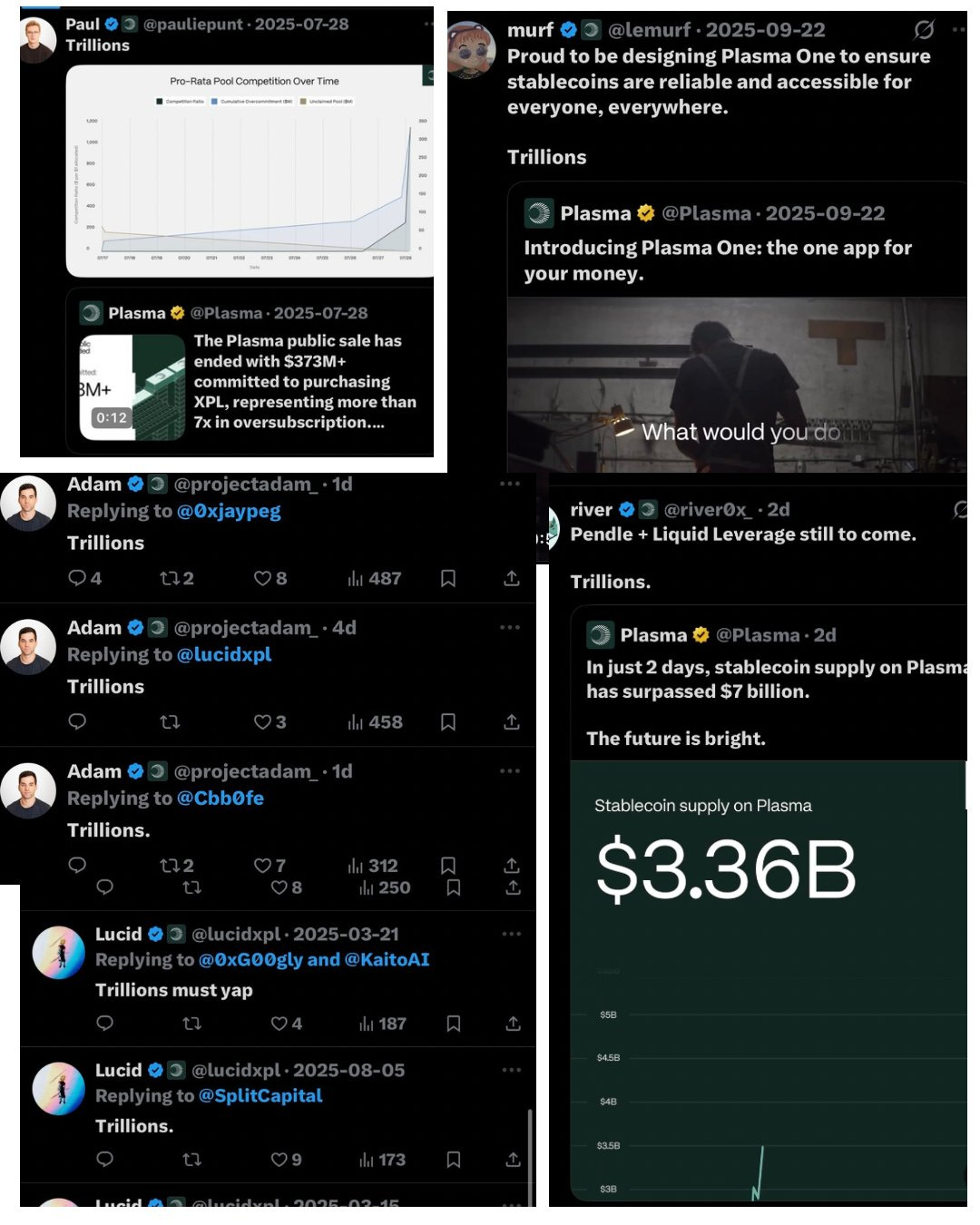

@Plasma launched in sept 2025 as a high speed, EVM compatible L1 blockchain built for stablecoins with with zero-fee transfers and bitcoin backed security. They raised over 70M from the public sale and funding rounds.

Within a week, Plasma attracted $5.5 billion in TVL ,and its XPL token soared to a $2.3 billion market cap; By every metric, this was a successful launch

But the trenches don’t care about your roadmap.

Here’s what gave memecoin traders their edge: they weren’t analyzing Plasma’s technology, they were counting word frequency.

In the week surrounding Plasma’s launch, the word “trillions” appeared so many times across team accounts, articles,announcements, influencer coverage. “Trillions in stablecoin volume.” “Trillions in transactions.”

Memecoin traders saw a simple equation: High narrative velocity (Stablecoins) + Repeated CatchPhrase + Fresh Liquidity = Attention Arbitrage

Within a few days, $TRILLIONS launched; a memecoin that did nothing except exist on plasma and carry the chain’s most-repeated word.

The edge wasnt technical analysis, it was pattern recognition: spot the narrative, capture the catchphrase, deploy before the hype cycle peaks.

This is attention arbitrage; trading narrative velocity instead of technological fundamentals.

The DEX Wars: Three competitors, One memecoin

Earlier before plasma launch, three perpetual dexes emerged each with major exchange backing.

@avantisfi - ( Base / coinbase ecosystem)

Launched on Coinbase ‘s Base L2

Pantera capital backing

marketed as “Base’s premier perps DEX

23M TVL at launch

@Aster_DEX - ( Bnb chain / Binance ecosystem)

Backed by Yzi Labs

Ex-binance team, Cz serving as advisor

46B trading volume, briefly supassing hyperliquid

@OfficialApeXdex - (Bybit ecosystem)

Backed by Bybit

Token Buyback

The narrative: exchanges competing for dex dominance , each trying to replicate hyperliquid’s success within their own ecosystem.

what memecoin traders saw: “hyperliquid competitor” everywhere. Three similar projects, same positioning ,all competing to be the hyperliquid killer.

Trader fatigue from endless hyperliquid competitor comparison and continuous rotation of attention shared amongst the three.

Within days, @niggaliquidx launched on solana

Not backed by anything, Not a hyperliquid competitor. Just a memecoin on solana leveraging the current attention economy around dex wars.

This is attention arbitrage in its purest form: The dex wars generated attention through legitimate development; AVNT building on base, Aster hitting $46B volume ( due to farming) , Apex integrating with bybit.

NiggaLiquid captured that same attention in hours by simply existing as a memecoin during peak dex wars discourse. Just a ticker that reference “Liquidity” at exactly the moment “HyperLiquid Competitor” Fatigue peaked.CONCLUSION

the edge; playing both sides of the casino.

Here’s what gives attention arbitrage traders their advantage: they’re not choosing between fundamentals and memecoins. They are playing both simultaneously.

The best memecoin traders aren’t ignorant of DeFi or events surrounding crypto; they understand it better than most. They read plasma’s documentation, followed partnership announcements and monitored team accounts. Not because they were investing in infrastructure, but because they were identifying where exactly attention will concentrate and when it will peak.

This is the attention asymmetry a lot of traders miss: DeFi Fundamentalists spend months researching new tech , analyzing tokenomics and waiting for the right entry. By the time the invest, the attention window already opened and closed. They’re playing for 2-5x returns over years but of course this isn’t bad for some port sizes.Memecoin-only degens chase pumps without understanding what created them. No narrative context. No pattern recognition. Just spraying and praying. They hit 100x sometimes , but mostly end up giving it back to the market.

Attention arbitrage traders do both; They have the information edge of researchers combined with the execution speed of a memecoin degen.

>They can analyze Plasma’s $5.5B TVL growth while simultaneously deploying $TRILLIONS or front running other traders to it .

>They can compare Hyperliquid competitors while launching niggaliquid.

The understand the narratives deeply enough to know when “trillions” will become the buzzword for plasma. They follow the dex wars closely enough to spot when “ Hyperliquid competitor” fatigue peaks. They don’t wait for fundamentals to play out; they front run the attention fundamentals generate.

The trenches can’t die because they’re not separate from “serious crypto’” they’re the same people , playing a different game.the formula is simple: spot the narrative → Identify the opportunity → Front run before the hype peaks → Exit before attention shifts → Repeat

The edge belongs to those who pay attention to everything while committing to nothing.